Depreciation_Calculator app for iPhone and iPad

Developer: 7SEALS.COM PTY LTD

First release : 22 Aug 2018

App size: 11.7 Mb

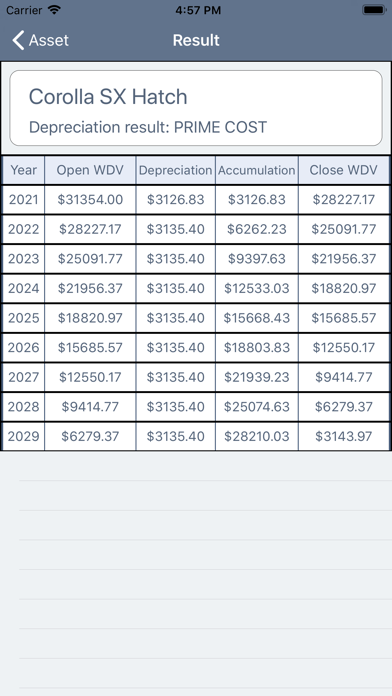

iParaV Depreciation Calculator provides various depreciation methods to calculate your assets depreciation schedule:

- Prime Cost

- Diminishing Value

(using Declining Balance and Double Declining Balance based on asset acquired date)

- Declining Balance

- Double Declining Balance

- AU Simplified Rule (used in Australia - 15% for 1st yr, 30% for the rest)

We also generate the result for a range of years and based on a changeable starting month of your financial year.

You can store and organize your assets with categories.

In-app purchase features:

- Allow storing more assets.

- Option to remove the advertisement.

Generating and emailing the annual depreciation report.

Also, export as a CSV file.

We dont collect any data of your input.